Example of Groupthink: The Perils of Panic Selling

Introduction

Updated March 29, 2024

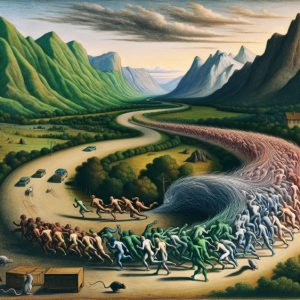

Groupthink psychology plays a significant role in investing. It refers to the herd mentality, where individuals follow the crowd and make decisions based on the actions of others. This collective mindset can sway markets and shape investment decisions, often leading to irrational behaviour.

During market declines, for instance, groupthink can result in panic-based sell-offs, amplifying losses for those caught in the wave. This phenomenon has been studied for decades, tracing back to the early days of stock market trading. Understanding and navigating this psychological landscape can be the key to success in the ever-changing world of finance.

However, a counterbalance to this collective mindset exists in contrarian investing. Contrarian investors aim to capitalize on the irrationality of the masses by taking positions that run counter to the overall market sentiment. They believe that when most investors are overly optimistic or pessimistic, it can lead to mispricings and opportunities for profit.

By exploring groupthink psychology, we can delve into the intricacies of this phenomenon and its impact on investment decisions. We can uncover the allure and dangers of following the crowd and the potential rewards for those who dare to break away from the herd.

Understanding the workings of mass psychology and adopting a contrarian approach can help investors confidently navigate the market and seek out opportunities that may have been overlooked. By doing so, they can potentially profit from market inefficiencies created by overreactions to news and events.

The power of groupthink psychology in investing is undeniable. However, investors can use this power to make more informed and profitable investment decisions by understanding this phenomenon and adopting a contrarian approach.

Navigating the Market with a Contrarian Mindset

The allure of groupthink psychology in investing is undeniable. It provides comfort and validation when others share our beliefs and investment decisions. However, this comfort can quickly become a trap when the herd mentality takes over, leading to irrational, panic-based decision-making.

A prime example of this phenomenon is the recent GameStop frenzy, where a group of retail investors banded together to drive up the stock price, only to see it come crashing down when the bubble burst. This event underscores the dangers of groupthink and the potential financial losses that can occur when investors follow the crowd without conducting their analysis.

Contrarian investing offers a way to navigate these market dynamics. This strategy involves going against the crowd and seeking out overlooked opportunities. It requires a firm conviction in one’s analysis and the ability to withstand short-term market fluctuations. While it’s not for the faint of heart, for those willing to take calculated risks, the potential rewards can be significant.

Understanding the power of groupthink psychology and adopting a contrarian mindset can be the key to success in investing. Investors can confidently navigate the market and potentially reap significant rewards by breaking away from the herd and seeking overlooked opportunities.

So, let’s embark on this journey into the captivating world of groupthink psychology in investing. We’ll discover how avoiding the lemmings and embracing a contrarian mindset can lead to fruitful investment outcomes. Remember, the key is not to follow the crowd blindly but to make informed decisions based on thorough analysis and a clear understanding of market dynamics.

Example of Groupthink: Navigating the Lemming Mentality”

In investing, understanding the power of mass psychology can be the key to success. This concept has been studied and observed for decades, tracing back to the early days of stock market trading. The mass mindset refers to the behaviour of individuals who tend to follow the herd and make decisions based on the actions of others. This herd mentality often leads to panic-based selloffs during market declines, which can cause further losses for those who follow the crowd.

To combat groupthink psychology, contrarian investing is a strategy that aims to capitalize on the irrational behaviour of the masses. This approach involves taking positions that are opposite to the prevailing market sentiment. By doing so, contrarian investors can exploit market overreactions and identify opportunities others may have overlooked. This strategy requires discipline and patience, as contrarian investors may need to hold positions for extended periods to see a return.

However, it’s important to note that contrarian investing is not a surefire way to make money. Like all investment strategies, it carries risks and requires careful consideration. However, by understanding the power of mass psychology and using a contrarian approach, investors can potentially identify opportunities for long-term growth.

Groupthink Psychology in Action: Avoiding Panic-Based Selloffs

In the ever-dynamic stock market, the masses often succumb to a predictable rhythm, marching to the beat of collective behaviour. While seemingly reassuring, this herd mentality becomes a perilous dance during market downturns, leading to ill-informed investment decisions driven by panic.

When faced with a market decline, the herd instinctively panics. Fear takes the reins instead of maintaining composure and assessing the situation objectively, prompting a mass exodus with panicked selloffs. This collective response exacerbates the market downturn and inflicts additional losses on those blindly following the herd.

History is a stark reminder that succumbing to panic during a market decline is a costly misstep. Those who hastily sell often miss the eventual market recovery. Meanwhile, those who maintain their composure and retain their investments reap the rewards of the subsequent upswing.

Understanding and navigating the mass mindset is paramount in stock market investing. Breaking free from the herd and making decisions grounded in rationality rather than fear is the key to financial resilience. In the tumultuous symphony of market fluctuations, those who resist the allure of panic-driven actions emerge as savvy investors, steering clear of the pitfalls that occur in the herd. So, in the face of market turbulence, remember: staying calm when others panic is the secret to survival and thriving in the unpredictable world of stock market investments.

Additional Insights on the Groupthink Psychology of Investing: Defying Conventional Wisdom

In the 1940s, the astute John Maynard Keynes dissected the stock market, unveiling its secret driver: not rational decision-making but the unpredictable “animal spirits” of investors. Today, this observation reverberates, echoing through the market’s tumultuous dance influenced by the collective psyche. While the allure of joining the crowd during market upswings is compelling, maintaining discipline and resisting impulsive decisions are paramount.

Venturing into the realm of contrarianism becomes a beacon for astute investors seeking opportunities hidden from the myopic gaze of the masses. A contrarian approach demands a steadfast long-term vision and the courage to swim against the prevailing current. It’s an investment strategy that transcends the ordinary, potentially paving the way for higher returns.

The essence lies in embracing the truth that anything worth having demands effort and patience. As the investment landscape weaves its unpredictable narrative, those who dare to defy the gravitational pull of groupthink psychology embark on a thrilling journey toward financial success. In this narrative, the contrarian spirit emerges as the guiding force, steering investors away from the mundane and toward the extraordinary. So, let the crowd chase illusions; for those who choose to stand apart, a world of unexplored possibilities beckons—a world where the rewards transcend the ordinary, waiting to be claimed by those bold enough to challenge the status quo.

Navigating the Currents of Groupthink

In the world of investing, navigating the currents of groupthink is essential. The pervasive mass mindset often leads to financial missteps, as investors sell when opportunity knocks and buy when caution signals.

Breaking away from groupthink requires more than mere knowledge; it demands the courage to challenge the status quo and embrace unconventional thinking. It’s about recognizing the thin line between genuine knowledge and the illusion of knowledge.

The journey toward financial independence involves shedding the shackles of conventional wisdom and venturing into uncharted territories. It’s a realm where innovation reigns supreme, and the rewards go beyond the mundane.

The late psychologist **Irving Janis**, who coined the term “groupthink,” emphasized the importance of independent thinking in decision-making. In his seminal work “Groupthink,” Janis wrote, “The more amiability and esprit de corps among the members of a policy-making in-group, the greater is the danger that independent critical thinking will be replaced by groupthink.”

Janis’s insights underscore the need for investors to break free from the echo chamber of consensus and forge their path. By embracing the role of the devil’s advocate, questioning assumptions, and seeking diverse perspectives, investors can mitigate the risks of groupthink and make more informed decisions.

The story of investing success isn’t written by those who blend into the crowd but by those who dare to stand out, ready to script their own narrative in the thrilling saga of financial independence.

The Perils of Groupthink: Three Case Studies

The Dot-Com Bubble

The late 1990s saw the advent of the Internet, a revolutionary technology promising to reshape the world as we knew it. This era, often called the “dot-com bubble,” was characterized by a surge in equity investments in internet-based companies or “dot-coms.” This investment frenzy was fueled by the collective belief that the Internet represented a new business paradigm, and traditional company valuation metrics were deemed obsolete.

This collective belief is a classic example of groupthink psychology in action. Groupthink, a term coined by social psychologist Irving Janis, refers to a psychological phenomenon where people strive for consensus within a group, often disregarding their doubts and beliefs. In the case of the dot-com bubble, investors were swept up in the euphoria of this new technological frontier. The fear of missing out (FOMO) on the potential profits led to a herd mentality, where investors blindly followed the crowd, pouring money into these dot-coms and pushing their stock prices to astronomical levels.

Media hype, bullish analyst reports, and tales of overnight millionaires further reinforced this group behaviour, creating an echo chamber that amplified optimism and suppressed scepticism. However, the dot-com party didn’t last. By 2000-2001, it became apparent that many of these internet companies were not profitable despite their high stock prices and had unsustainable business models. The bubble burst, leading to a dramatic crash in stock prices known as the “dot-com crash.”

Investors lured by the promise of quick riches were left nursing significant financial losses. This painful lesson is a stark reminder of the dangers of groupthink in investing. It underscores the importance of independent analysis, scepticism, and the willingness to diverge from the herd when investing.

The 2008 Housing Market Crash: A Cautionary Tale

The years leading up to the 2008 financial crisis saw a booming housing market, with home prices on a seemingly unstoppable upward trajectory. Easy credit and lax lending standards fueled a surge in home buying and mortgage lending, even to borrowers with poor credit histories.

Groupthink played a significant role in this crisis. The collective belief in the housing market’s infallibility led to risky lending and investment practices, with banks offering mortgages to individuals unlikely to repay them. The media and financial analysts reinforced this optimism, creating an echo chamber that suppressed scepticism.

However, when interest rates rose in the mid-2000s, many homeowners defaulted on their mortgages, causing the housing bubble to burst. The fallout from this crash spilt over into the broader economy, leading to the worst recession since the Great Depression.

The Renaissance polymath **Leonardo da Vinci** once said, “It is easier to resist at the beginning than at the end.” This sage advice is particularly relevant to the 2008 housing market crash. Had more individuals and institutions resisted the allure of easy profits and maintained a critical perspective on the unsustainable growth in housing prices, the severity of the crisis might have been mitigated.

Da Vinci’s wisdom underscores the importance of independent thinking and rigorous analysis when making investment decisions. It also reminds us to be cautious of the herd mentality, particularly in complex and interconnected markets like housing and finance.

The 2008 housing market crash is a cautionary tale, highlighting the potential consequences of allowing groupthink to drive decision-making. Investors can navigate even the most challenging market conditions with greater clarity and resilience by heeding the wisdom of great thinkers like Leonardo da Vinci and maintaining a commitment to critical analysis.

The GameStop Saga: A Clash of Wills

In early 2021, GameStop, a struggling video game retailer, became the unlikely battleground between Wall Street hedge funds and retail investors from the Reddit forum r/wallstreetbets. These retail investors rallied behind GameStop, buying shares en masse to trigger a ‘short squeeze’ against hedge funds betting on the company’s decline. Fueled by anti-establishment sentiment and speculative fervour, GameStop’s stock price skyrocketed, causing substantial losses for short-selling hedge funds.

The GameStop frenzy exemplifies groupthink, a psychological phenomenon where group members strive for consensus and ignore dissenting views. In the echo chamber of r/wallstreetbets, the mantra ‘hold the line’ reverberated, encouraging members to keep buying and holding GameStop shares despite inflated prices and shaky fundamentals. The collective belief in taking on Wall Street titans and turning the tables on professional short sellers strengthened the group’s resolve.

GameStop’s stock price plummeted as the frenzy cooled, leaving many retail investors with significant losses. This dramatic turn underscored the risks of following the herd and neglecting rational analysis.

The GameStop saga echoes the timeless wisdom of ancient traders. In ancient Greece, **Thales of Miletus**, a philosopher and mathematician, used his knowledge of astronomy to predict a bumper olive harvest. He secured the rights to use all the olive presses in Miletus and Chios, only to rent them out at a premium when demand soared. Thales demonstrated the importance of independent analysis and contrarian thinking in making profitable trades.

Another example comes from ancient China, where **Fan Li**, a prosperous merchant and advisor, emphasized the importance of adaptability in changing market conditions. Fan Li’s principle of “buy when there is blood in the streets, even if the blood is your own” highlights the value of maintaining a long-term perspective and being prepared to capitalize on opportunities during market downturns.

The GameStop saga and the wisdom of ancient traders underscore the importance of independent thought, critical analysis, and risk awareness in investment decisions. In an era where digital platforms can amplify groupthink, investors must navigate the landscape with discernment and caution, focusing on fundamentals and long-term value rather than short-term speculative fervour.

Conclusion: Mastering the Market Symphony Through Individuality

In the grand orchestration of the stock market, grasping the intricacies of groupthink psychology emerges as a pivotal chord for investment success. The problematic dance of the herd often leads to chaotic selloffs and regrettable decisions, casting shadows of losses for those entangled in collective behaviour.

Enter the contrarian maestro, wielding a strategy that capitalizes on market overreactions and unearths hidden treasures overlooked by the crowd. While not foolproof, it becomes a compass for navigating the irrational waves stirred by the masses.

Resisting panic-driven selloffs becomes the anthem for sustained growth. Those who weather market declines with poise reap the rewards of eventual recovery, while the panic-stricken are left behind. It’s a testament to the enduring power of staying calm amid market turbulence.

The wisdom of John Maynard Keynes reverberates through time—his recognition of the influential “animal spirits” shaping the market echoes in the actions of today’s masses. Discipline becomes the guardian against impulsive herding, fostering resilience against market unpredictability.

In summation, decoding the language of mass psychology and embracing a contrarian spirit empowers investors to transcend the collective humdrum. While not devoid of risks, this approach unveils opportunities and sets the stage for enduring success. In this symphony of investments, effort, patience, and rationality become the virtuoso notes that break free from the chains of groupthink psychology, orchestrating a harmonious melody of favourable outcomes.

Other Articles Of Interest

Financial Freedom Book: A Pinch of Salt, a Splash of Whiskey

Contrarian Investing: The Art of Defying the Masses

Stock Market Psychology Chart: Mastering Market Emotions

Murphy’s Law and the Stock Market Fear Index: A Cautionary Tale

The Yen ETF: A Screaming Buy for Long-Term Investors

Embracing Contrarian Meaning: The Magic of Alternative Perspectives

When is the Best Time to Buy Stocks?: Strategic Approach

Examples of Groupthink: Instances of Collective Decision-Making

Mob Mentality Psychology: Understanding and Profiting

IBM Stock Price Prediction: Time to Buy or Fly?

Examples of Herd Mentality: Lessons for Learning and Earning

When is the Next Stock Market Crash Prediction: Does it Matter?

Inductive vs Deductive Analysis: The Clash of Perspectives

Investor Sentiment Index Data: Your Path to Market Success

Unraveling Market Psychology: Impact on Trading Decisions

Dark Pools Stock Market: Unveiling Manipulation and Thievery